Irs Quarterly Payments 2024 – Self-employed business owners and others who don’t have withholding instead make quarterly estimated payments of their taxes based on earnings for that quarter. The deadline for the fourth installment . Your guide to IRS estimated tax payments—including who needs to pay them and when. .

Irs Quarterly Payments 2024

Source : www.taxpayeradvocate.irs.govTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com2024 Tax Deadlines for the Self Employed

Source : found.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com2024 IRS Tax Deadlines Filing Calendar

Source : www.aarp.orgThe Beginner’s Guide to Navigating & Paying Estimated Taxes

Source : hostagencyreviews.comWhy You Might Owe More in 2024 If You Don’t Pay Your Estimated

Source : www.forbes.comTax Filing Deadline Dates 2024

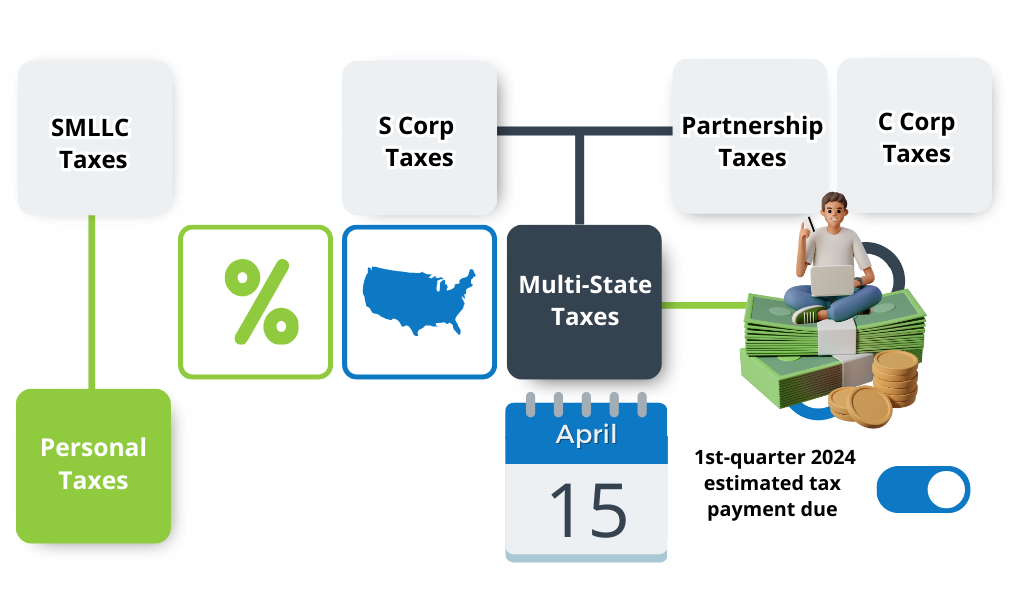

Source : www.fusiontaxes.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comTax Tips Taxpayer Advocate Service

Source : www.taxpayeradvocate.irs.govIrs Quarterly Payments 2024 Tax Tip: Estimated Tax Payments TAS: Tax season is almost here. Here’s an overview of what to know ahead of filing your 2023 taxes, including deadlines, exemptions, tax credits and more. . You’ll pay a higher price for underpaying estimated taxes. The IRS has raised its penalty interest rate for individuals, to 8% per year. This penalty is assessed for underpayment or late payment .

]]>